Finance: Stock Market Crashes Summarized

| YEAR | DESCRIPTION |

|---|---|

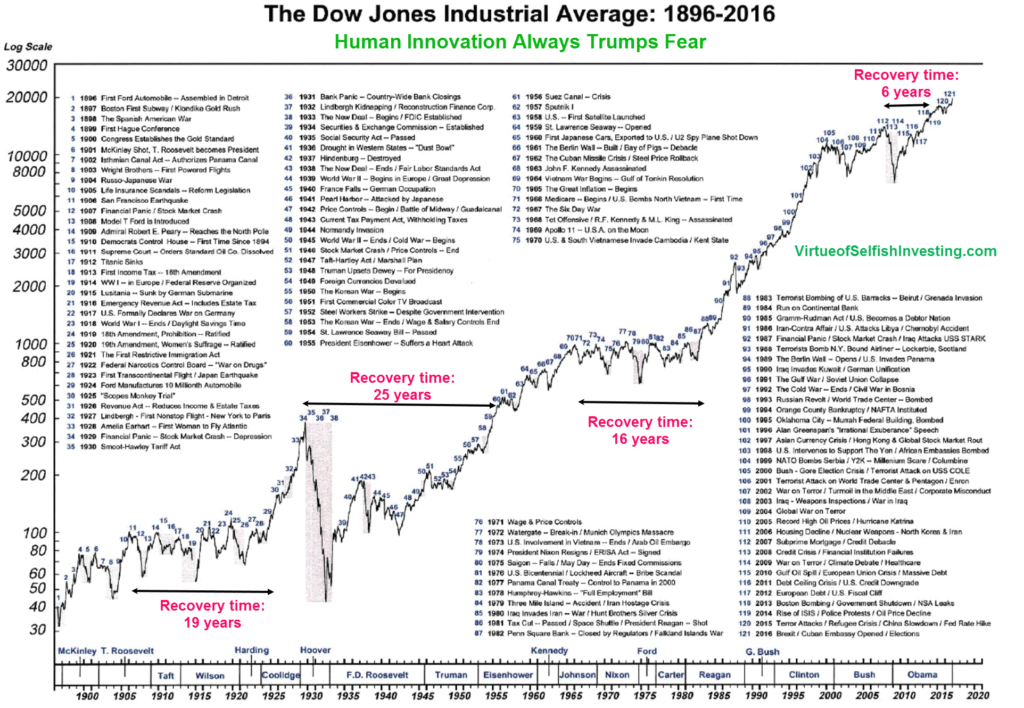

| 1929 | “Black Monday” The Dow Jones index was down about 13%, and another 12% the next day… Brief history: The Dow index grew about 5X in about 5 years before the crash. People were buying stocks with borrowed money, speculating that the stock market keeps rising. This was the “roaring 20’s” where consumers took on way too much debt.Then, the Great Depression followed the crash. And it took about 25 years to recover; the Dow index finally regained its value in 1954. |

| 1987 | “Black Monday” The Dow index was down about 22%. Options and derivatives were were found to be the cause for the crash. |

| 2000 | “Dot-com Bubble” The Nasdaq index grew about 5X in about 5 years before the crash. Many startups had no business plans. Many of these startups also had no earnings (they called it pre-revenue). |

| 2008 | “Housing Bubble” (AKA, Financial Crisis) Risky borrowers were able to get loans with little ability to repay. Risky mortgage practices such as sub-prime loans were the cause. Some of these loans were interest-only loans; that means, you will never be able to pay off your loan. |

| 2020 | “COVID-19 Pandemic” (AKA, Coronavirus) The Dow, S&P500, and the Nasdaq index were down about 12%. The economy was shutdown around March 2020. |

| 2024 | ??? |

Historical Data For The DJIA From 1896 – 2016